Phate Zhang/CnEVPost Aug 22, 2022 19:32 GMT+8

Lithium resources are sufficient and the Chinese NEV market will not be materially affected by lithium prices in the coming months, according to CPCA secretary-general.

The rapid growth of China’s new energy vehicle (NEV) industry is sending demand for lithium soaring, and for imported lithium carbonate as well.

In July, China imported 9,369 tons of lithium carbonate, down 67 percent from June but up 108 percent from a year ago, according to data from China’s General Administration of Customs.

The average import price of these lithium products in July was $62,498 per ton, down 3 percent from June but up 878 percent from a year ago.

In April and May, port clearance was affected by the Covid outbreak, leading to a concentration of lithium carbonate imports in those months arriving in June, sending imports soaring that month, The Paper said in a report today, citing Huaxi Securities.

Therefore, it is normal for lithium carbonate imports to decline in July compared to June, Huaxi Securities said.

Chile and Argentina are the main countries for China’s lithium carbonate imports, contributing 8,185 tons and 1,128 tons, respectively, in July.

The average price of China’s lithium carbonate imports from Chile in July was $67,466 per ton, and Argentina was $27,022 per ton.

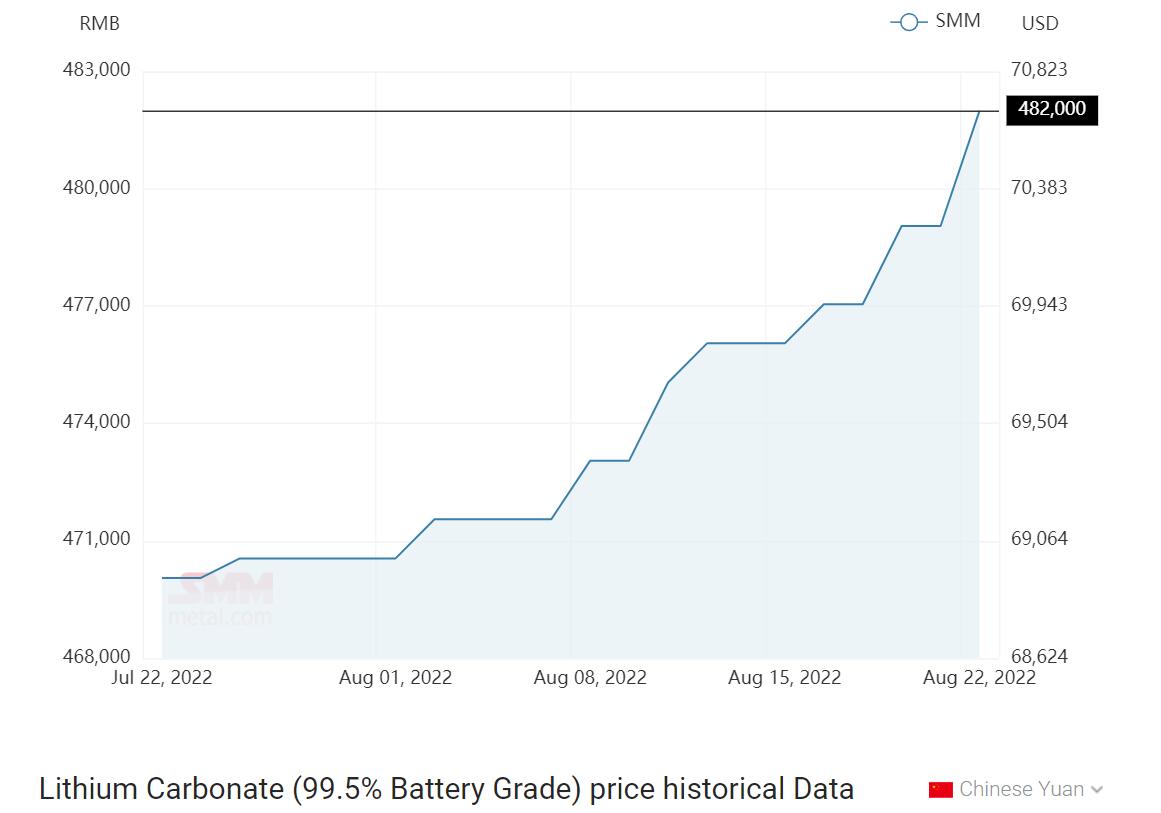

In China’s domestic market, the average price of battery-grade lithium carbonate was $469,523 per ton ($68,640 per ton) in July, essentially unchanged from June, according to Shanghai Metals Market (SMM).

On August 22, battery-grade lithium carbonate was quoted at RMB 482,000 per ton in China, according to the SMM.

(Credit: Shanghai Metals Market)

Current high lithium carbonate prices do not reflect true supply and demand, as most contracts are long-term and only a small fraction of those deals are sold at high spot prices, Cui Dongshu, secretary-general of the China Passenger Car Association, said in a report released today.

Factors including sellers’ hesitation to sell, buyers’ hoarding and middlemen speculation led the market to believe there might be a problem on the supply side, Cui said.

At the same time, the development of the NEV market beyond expectations seems to be confirming the judgment that there is a shortage of supply, further triggering a continuous rise in lithium carbonate prices, according to Cui.

As the effect of the US Federal Reserve’s rate hikes becomes apparent, lithium prices are likely to remain between RMB 470,000-500,000 per ton, with little probability of exceeding RMB 500,000, Cui said.

“My judgment is that lithium resources are sufficient. In the coming months, the NEV market will not be materially constrained by lithium prices, and sales will continue to grow strongly,” Cui said.